Developing Technology Roadmap for Integrating Digital Asset Services in Financial Services

How to integrate Digital Asset services in Financial Services

Developing Technology Roadmap for Integrating Digital Asset Services in Financial Services

Digital assets, especially cryptocurrencies, have long been a new playground only among tech-savvy investors. Meanwhile, more and more bank clients are asking about the possibility of further diversifying their assets thanks to this class.

With rising awareness, falling volatility and new regulations, one can expect this trend to continue to grow. This will also increase clients' demands, not only in terms of cryptocurrency selection, but also in terms of other, more complex offerings, such as Lobard loans, new revenue streams like staking, but also access to DeFi business models.

In addition, this trend can be expected to be fuelled by the issuance of CDBS, i.e. Central Bank Crypto Currencies and inflationary tendencies - Bitcoin was originally developed as an inflation protection measure.

All of this poses new, major challenges for financial institutions. Their infrastructure and current IT systems roadmap is not made for many of the new requirements.

In this article we will look at this development and discuss ways in which these new demands can be met.

What is a Technology Roadmap?

A technology roadmap, sometimes also called IT roadmap, should be part of a far-sighted IT strategy, and describes a medium- to long-term plan to use new technologies to meet existing and future customer needs. This also shows the importance of the interplay between IT strategy and business strategy, which should be developed closely together.

The Importance of Technology Roadmaps and their Role in Enabling Innovation

Since a technology roadmap lays the foundation for many future developments, and thus determines not only the structure of the future infrastructure, but also the shape of future offerings and business models, the importance of a robust decision-making process cannot be underestimated.

Simply put, the technology roadmap determines the future shape of the company, from its organisational structure, to how it operates, how it deals with customers, to what it offers.

Benefits of Technology Roadmapping in Businesses, Unlocking the Power of Technology

Given this immense strategic importance, it is not surprising that many companies are reluctant to devote the necessary attention to this subject. They often limit themselves to making improvements to the existing infrastructure, mostly with the to cut costs.

While this avoids a complex decision-making process, they also forego the opportunities offered by new technologies and risk losing relevance in the future when competitors bring innovative offerings to the market and their customers are no longer satisfied with their services.

A robust technology strategy not only has the potential to optimise existing processes and enable new offerings. Just as importantly, it allows the company to respond much more efficiently and quickly to future demands. As we all know, technology development is accelerating year by year, and so is the competitive pressure. Customer expectations are also following this evolution - in banking, not so long ago, customers were satisfied with going to a counter for a payment and having it executed only after a few days. Today, they expect to be able to do it on their mobile phone and are frustrated if the recipient has to wait even a day.

This trend is even more accelerated in the case of digital assets. Clients are used to being able to trade 24 hours a day, to the the availability of real-time pricing and instantaneous execution of trades is standard for them.

Overview of Technology Roadmap Types and Key Components

Just as technology adoption must be considered from many perspectives, a technology roadmap must also take many aspects into account. Sometimes people talk about different types of technology roadmaps, but these are really just different perspectives on the same topic, with different focuses. Regardless of which perspective one takes, it is important to have considered all components.

Technology Roadmaps Types

Typical perspectives on a technology roadmap, sometimes also called types of technology roadmaps, are:

· Product Roadmap: This type of technology roadmap is focused on outlining the development and release of specific products or services. It typically includes timelines, resource allocation, and milestones for each stage of the product development cycle.

· Platform Roadmap: This type of technology roadmap focuses on the development and enhancement of the underlying platform or infrastructure that supports a company's products or services. It includes timelines and priorities for technology upgrades, enhancements, and improvements.

· IT Roadmap or systems roadmap: This type of technology roadmap is focused on outlining the development and implementation of IT systems and infrastructure. It typically includes timelines, budgets, and priorities for upgrading or replacing existing systems, implementing new ones, and managing IT operations.

· Capability Roadmap: This type of technology roadmap is focused on outlining the development of specific capabilities or competencies, such as data analytics, artificial intelligence, or cybersecurity. It includes timelines, resource allocation, and milestones for building and enhancing the company's capabilities in these areas.

· Digital Transformation Roadmap: This type of technology roadmap is focused on outlining the steps and milestones necessary to transform a company's business model, operations, and customer experience through the use of digital technologies. It includes timelines, budgets, and priorities for implementing new technologies, building new capabilities, and driving cultural change within the organization.

Key Components of a Technology Roadmap

(1) Vision

The technology roadmap should start with a clear and inspiring vision for how technology will support the company's overall strategy and business needs. This vision should be communicated to all stakeholders, including employees, customers, and investors. This shows how important it is to jointly develop the business strategy and the IT strategy, the core element of which is the technology strategy.

(2) Goals and Objectives

The technology roadmap should clearly outline the specific goals and objectives that will be achieved through the implementation of new technologies. These goals should be measurable and aligned with the company's overall strategy.

(3) Prioritization

The technology roadmap should prioritize the most important initiatives based on the company's strategic goals, resource constraints, and risk considerations. This prioritization should be reviewed and updated regularly to ensure that the roadmap remains relevant and effective.

(4) Timelines

The technology roadmap should include clear timelines for each initiative, including milestones and deadlines. This will help ensure that the roadmap stays on track and that progress can be tracked and communicated effectively.

(5) Resource Allocation

The technology roadmap should outline the resources required to execute each initiative, including personnel, funding, and technology infrastructure. This will help ensure that the company has the necessary resources to execute the roadmap successfully.

(6) Risk Management

The technology roadmap should identify and mitigate potential risks associated with each initiative, including technical, financial, and organizational risks. This will help ensure that the company can navigate potential challenges and achieve its goals.

(7) Performance Metrics

The technology roadmap should include clear metrics for measuring the success of each initiative. These metrics should be aligned with the company's overall goals and should be regularly reviewed and updated based on performance.

From Custody to DeFi: Building a Robust Technology Roadmap for Offering Digital Asset Services in Banking

Defining comprehensive, far-sighted technology roadmaps is a particularly difficult challenge for companies in the financial industry. For banks, insurance companies and other service providers in this industry, trust plays a central role, both towards their customers and investors, as well as towards regulators.

And change, especially one as profound as a redesign of core infrastructure, is always associated with unknowns and risks. This usually involves building on an existing infrastructure, which typically has a strong focus on minimising risk, meeting complex regulatory requirements and fulfilling standard requirements for accounting and reporting, for example. For those reasons, often standard products were used, for example a standard core banking system, which makes the infrastructure very cumbersome and difficult to modify.

Of course, one could hope that the developers of standard banking solutions would build the desired functionalities around digital assets into their products - that would be the easiest solution for the financial services companies. However, we are still early in this development, and until a large part of their customers ask for it, these companies will not take on this complex and expensive task. But even if they decide to do it, they will need a lot of time, and also experts who are hard to find.

Many financial institutions do not want to and cannot wait for their system suppliers to incorporate the digital asset functionalities they want. They want to attract customers now with new services, or at least not lose any to more innovative companies, and also remain attractive to a young clientele. And finally, they want to build up competencies early on that could soon become central to their business - which is particularly important for digital assets.

What are Digital Assets & Why they are Important in Financial Services?

The first digital asset with global reach was Bitcoin, with its launch in 2009. This asset class has grown rapidly since then, and now - as of 2023 - includes over 20,000 cryptocurrencies, as well as many other assets such as smart contract platforms on which assets such as NFTs and other tokenised assets are based, but also on-chain derivatives, DeFi applications and, in the near future, probably a whole range of CBDCs (Central Bank Digital Currencies).

While there is already a great demand for the most important cryptocurrencies - for example Bitcoin (BTC), Ethereum (ETH), Tether USD (USDT) - it is difficult to predict which cryptocurrencies will prevail in the long term and how they will develop.

It is equally difficult to predict which other digital asset applications will find favour with customers. For some banks specialised on such products, the opinion a few years ago was that clients would see the potential of tokenisation of assets as the most attractive application. Instead, NFTs - digital images whose ownership is registered on the blockchain - have seen incredible success. In retrospect, this is not surprising, as complex tokenised assets have many more risk factors to consider than relatively simple NFTs.

In any case, there is already a lot of money being invested in these assets - around USD 4.7 bn globally in April 2023 - and strong growth is forecast to continue over the next few years. Should the major central banks decide to offer CDBCs to a wider audience in the future, growth could accelerate considerably.

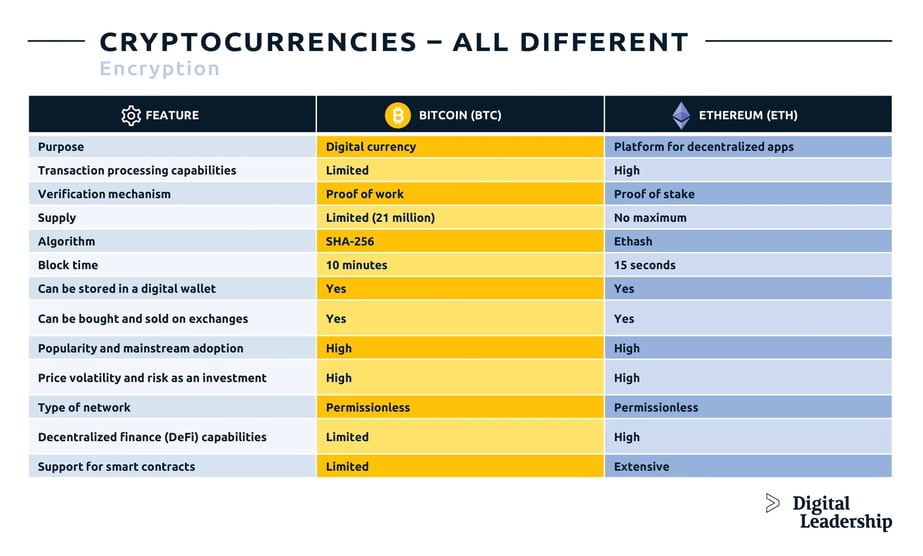

(1) Crypto Currencies

Cryptocurrencies currently form the core of the digital asset market, and also a large part of its total value - although this is not easy to measure, as the value of an NFT, for example, is only determined with a trade. Bitcoin dominates with around 47% of the value of all cryptocurrencies as of April 2023, followed by Ethereum.

But even if cryptocurrencies appear similar at first glance, there are very fundamental differences between them. Bitcoin, for example, was built purely as a store of value. Ethereum, on the other hand, is a platform for smart contracts, i.e. digitally created and decentrally stored contracts that allow, for example, the purchase or sale of a token (e.g. NFT, but also much more complex ones) to automatically transfer the ownership of the asset.

Only slowly is the understanding of the various digital assets growing in the financial industry. This can be seen, for example, in the fact that until now the prices of cryptocurrencies have correlated with each other - and in particular with the value of bitcoin - even though there are completely different purposes behind them.

If the financial industry wants to play its traditional role in cryptocurrencies, it needs to build up a lot of knowledge and develop new methods and system capabilities to understand and communicate the risks, potential applications and trends in the performance of these assets to its clients.

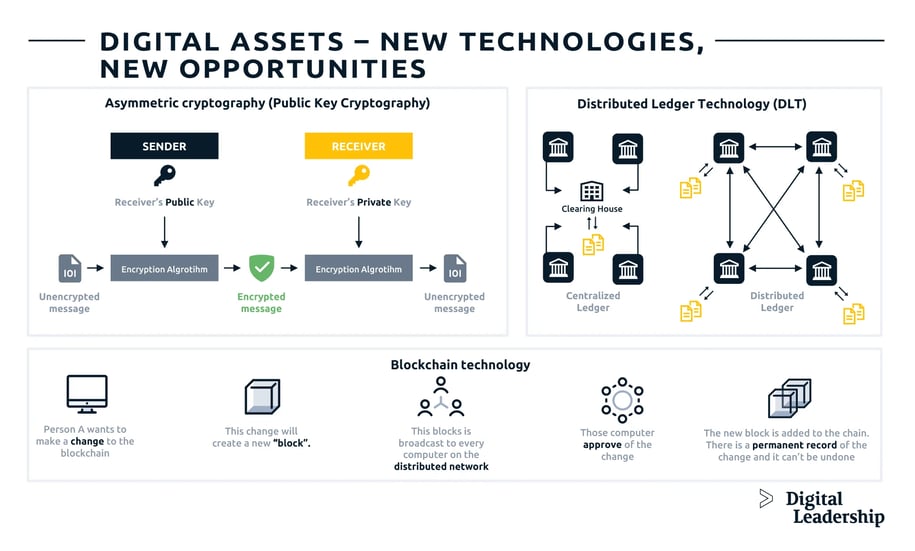

(2) Blockchain Technology

Blockchain - although often mistakenly used synonymously with Bitcoin - is a new technology that relies on a decentralised network of users rather than a central repository to store information. If this data is a ledger, for example in the case of bitcoin, both its security and the control of the transactions based on it must be ensured. This happens through the use of cryptographic procedures, in most cases - also in the case of Bitcoin or Ethereum - on public key cryptography.

However, there are many other possible applications for blockchain technology. Wherever data can be stored in a decentralised manner, can be accessed from anywhere and the information should always be available in real time, this technology comes into question. In addition, the security of the data is given if implemented correctly, as it is easier to attack a central database than a wide network of data nodes.

Banks are thus also discovering blockchain technology solutions for other applications, for example to carry out transactions more efficiently without needing a settlement agent. However, the potential of this groundbreaking technology is far from exhausted and we can look forward to many exciting developments!

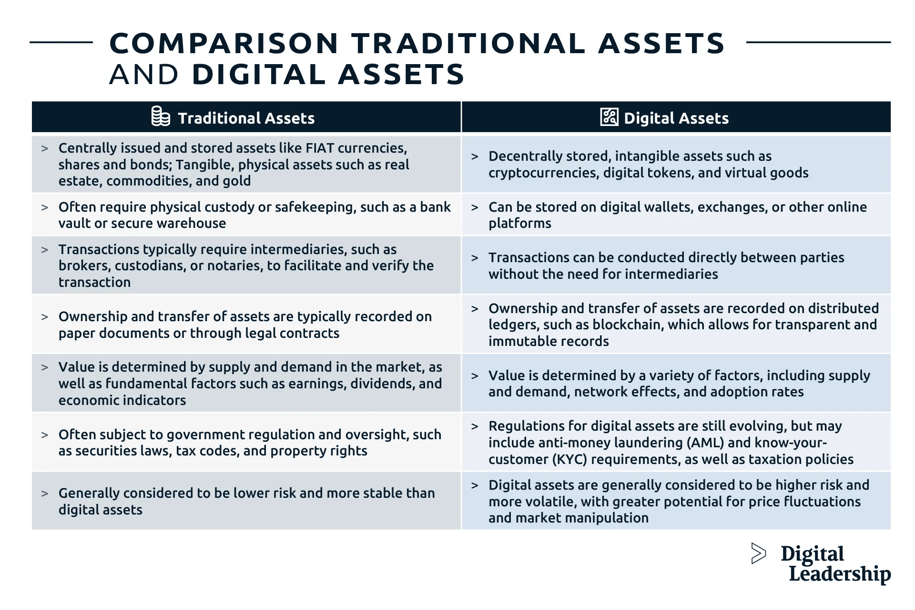

Digital Assets vs Traditional Assets

It is difficult to directly compare digital assets with traditional assets because they are very different in many ways and because there is a whole range of different manifestations on both sides. However, here is an attempt at the most important aspects for the financial industry:

Designing Technology Roadmaps for Digital Asset Services in Financial Services

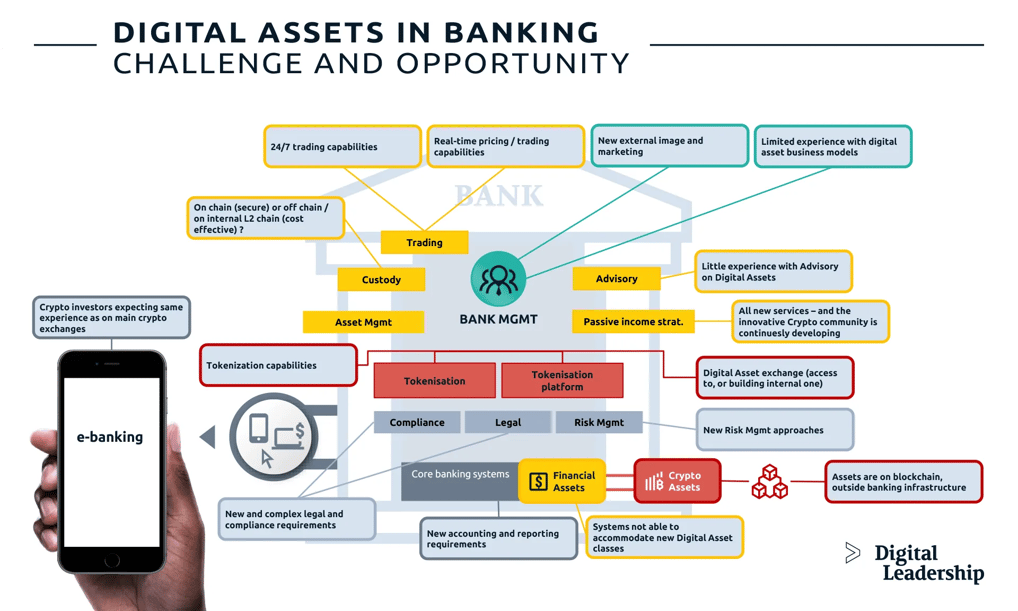

If a financial institution wants to offer services in the area of digital assets, not only does the infrastructure have to allow for such services, but new customer requirements also have to be met, such as 24/7 access to custody and trading services, real-time price assessments, but also the security that customers have come to expect from the blockchain.

In addition, all other central banking functions must be extended to the new asset class, such as risk management, accounting, customer and regulatory reporting or investment advice.

If a financial institution wants to offer more complex, new services, such as staking, access to DeFi offers, tokenisation of assets or their trading, completely new functionalities must be built.

A bank, for example, will rarely replace its core infrastructure because of digital assets - it would be too complex and expensive, and there is often no proven, standard replacement for it. The core business of the bank, the services around traditional assets, remains in place and continues to contribute to a large part of the revenue.

A technology roadmap must therefore be defined in which the existing and new technologies complement each other. Whereby it is to be expected that over time the old infrastructure will be replaced by a new one that covers all asset classes - but that is a long-term goal.

For each new function that is to be offered, the question arises as to whether it makes sense to integrate it into one's own infrastructure or whether one can fall back on the services of a third party.

Step (1): Defining Business Goals & Objectives

So the medium to long-term goals should be set first. The questions to be answered could be, for example:

What are the expectations of the key stakeholders - shareholders, board members, executive management ?

Which products should be offered ?

To what extent should digital assets be integrated into existing products (for example, Lombard loans or advisory services) ?

With which products do you want to differentiate yourself from the competition ?

Do you want to take this opportunity to update the customer experience?

Where do you want to build up know-how in the internal teams ?

What are current system capabilities and the IT systems roadmap ?

Which new systems could not only provide the required digital asset functionality, but also improve current capabilities ?

Of course, this is only a small selection of questions that arise. This requires a close alignment of the IT strategy with the business strategy.

Step (2): Assessing Current State & Identifying Opportunities

The implementation of new digital asset offerings will depend heavily on the existing infrastructure and the current IT strategy, and will require an adjustment of these, especially to the IT systems roadmaps.

Here is an - incomplete - list of functions and offerings, and the arguments for integration in the bank's own systems, or as an offering by an external provider:

Step (3): Ensure Regulatory Compliance

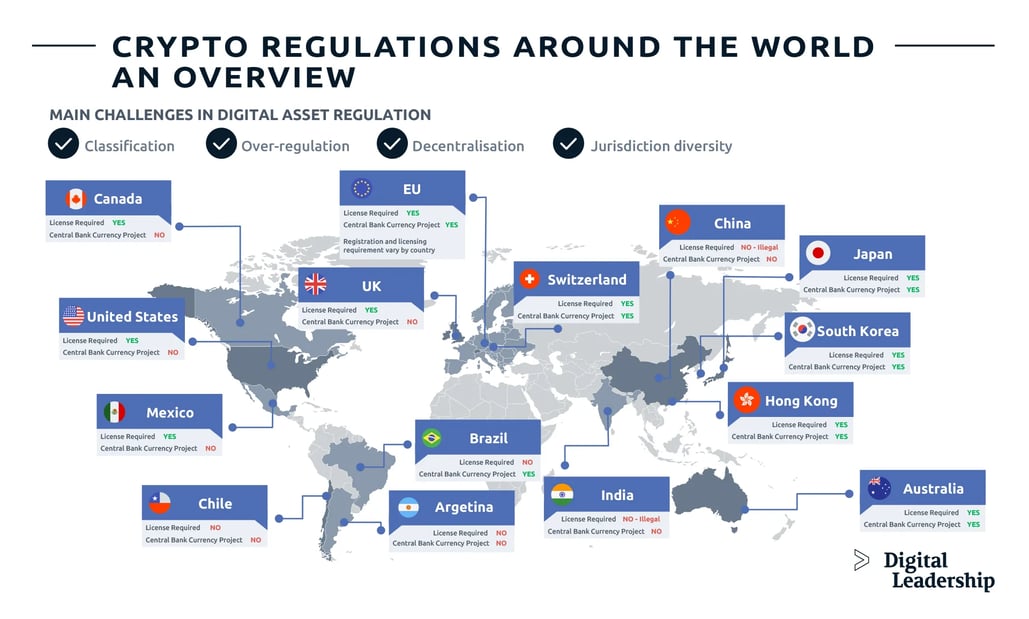

The regulation of digital assets presents regulators with new, previously unknown challenges. The biggest ones are the decentralised structure of these assets - there is no central officer to whom one can impose responsibility for implementing set rules - and their global nature. Regulators from different countries were not used to working closely together until recently. On the one hand, each country is interested in establishing control that is advantageous for the specific country; on the other hand, there is a danger of losing competitiveness through overly restrictive regulation.

On this topic, the EU has seized the opportunity - similar to GDPR - with the MiCA framework to define a regulation that applies not only in EU countries, but also to every company who does business with EU citizens. In doing so, it is creating a de facto global standard. It remains to be seen whether this regulation will actually prevail worldwide. At the moment, however, the regulatory landscape is still very immature and fragmented.

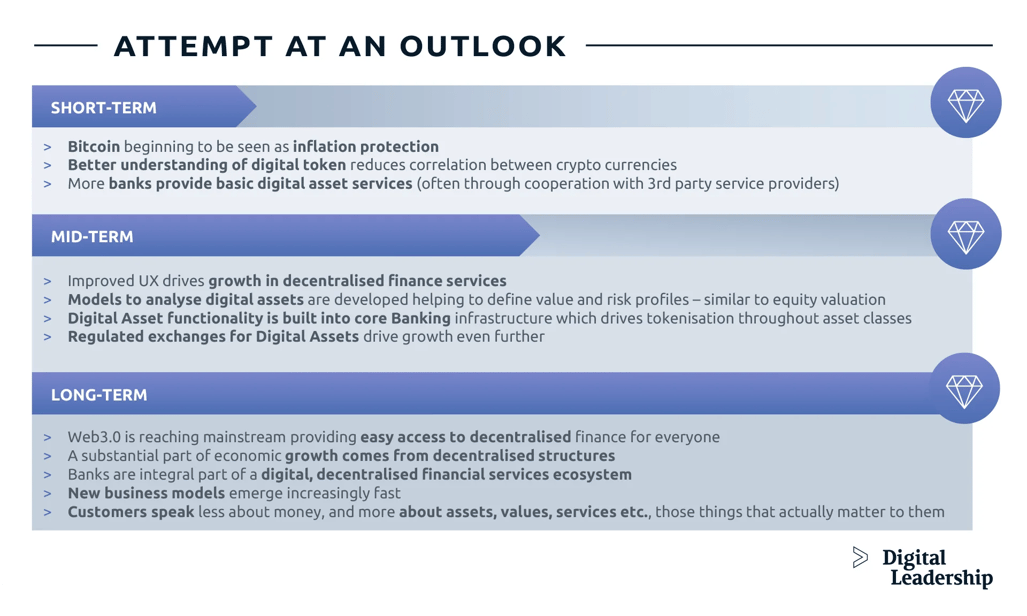

Outlook

Of course, an outlook is always associated with great uncertainties, especially when it comes to a medium to long-term perspective on such a disruptive technology. Here are some predictions, however, which should be read with a healthy scepticism: